The COVID-19 pandemic has caused an unprecedented economic downturn, and small businesses have taken the brunt of the financial damage. According to the National Bureau of Economic Research, the number of working business owners plummeted by 3.3 million between February to April last year—a drop not seen even during the Great Recession.

But while the coronavirus spared no demographic, it’s clear that some groups were harder hit than others. The losses were especially severe for minority and women-owned businesses, which experienced between a 25 percent to 41 percent drop in active business owners during the same months. If you’re among the minority or women entrepreneurs whose livelihood has been hamstrung by COVID-19, we have a few pieces of advice to help you get back on your feet.

OPTIMIZE YOUR CASH FLOW. The first step to better financial health is taking stock of your cash flow. Financial problems usually stem from either your income or your expenses, so look at these areas of business operation for any points of improvement. Luckily, are still avenues for revenue growth mid-pandemic if you know where to look. For example, try to understand the sales process and funnel in the context of the pandemic to identify new opportunities, reach customers, and outmatch competitors. If necessary, you can downsize on operations to reduce costs and stay afloat.

CONSIDER USING YOUR STIMULUS CHECK. As of March 25, the U.S. government has sent out 127 million stimulus checks amounting to a total of $325 billion. Chances are, you’ve already received yours to spend on essential goods. But if you’re fortunate enough to already be covered on that front, you can also use your stimulus check for debt repayments for your business. It’s a stopgap measure, but still effective in keeping interest from spiraling out of control and causing your company to go under. As such, make sure to prioritize high-interest loans before anything else.

BE ACTIVE ON SOCIAL MEDIA. With everyone staying indoors, social media usage has increased—and with it, the importance of social media marketing. According to an exploratory study on pandemic-iinduced social media marketing behaviors in the U.S., consumers have been using social media more often to evaluate products and decide on purchases. You can take advantage of this by increasing your online presence, which you can practically do for free. Websites like Facebook and Twitter even have built-in data analytics that allow you to see which kinds of posts are most effective, and what types of audiences you’re attracting. You can draw insights from these to better inform your marketing strategy.

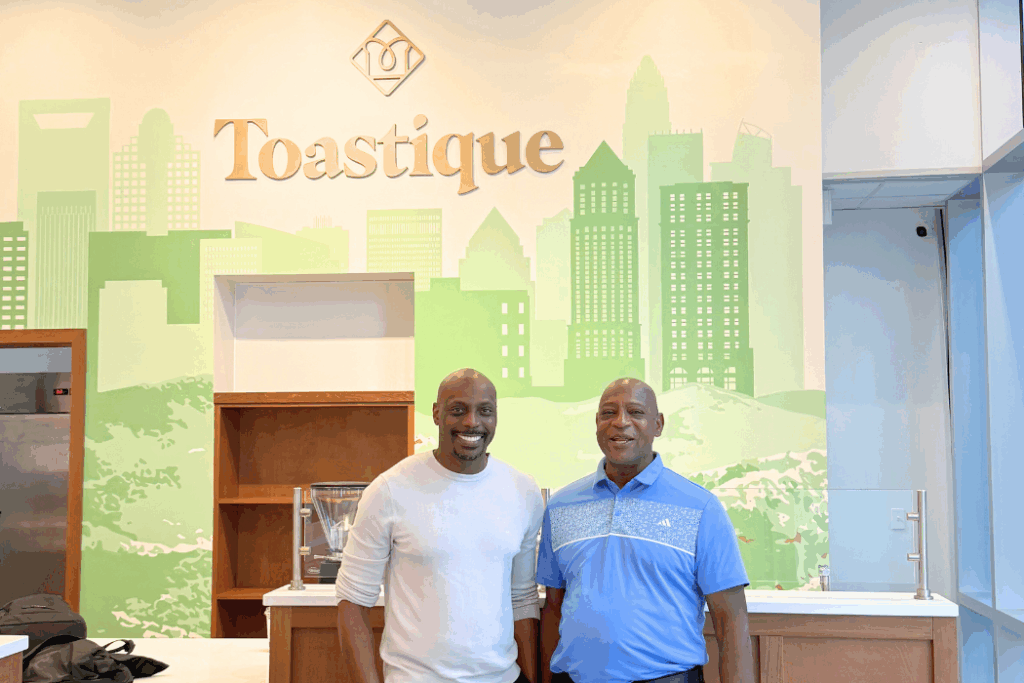

CHECK YOUR LOCAL RESOURCES. Financial aid applications have been made available for small businesses at the state and federal levels. For example, in North Carolina, qualified minority- and women-owned businesses have access to guidance and up to $12 million in grants to help them recover from the pandemic’s economic impact. Aside from that, consulting services with business mentors are also possible through the SCORE mentorship program with the U.S. Small Business Administration.

CONSOLIDATE DEBT. While it won’t make your outstanding loans magically disappear, debt consolidation is a good way of making them more manageable. By taking out a single loan to settle all your other financial obligations, you can better pay on more favorable terms. Depending on your credit score, this should be easy to do by availing of a personal loan. However, if your credit score is poor, you might need to turn to family or friends for help instead. Debt consolidation might be a temporary solution, but it can buy you enough time to get your finances in order.

The pandemic has been hard for business owners, especially those in the minority sector. Though times may be difficult today, we hope the points above will help you find your footing to recover from the economic impact of COVID-19.

Photo by RODNAE Productions from Pexels