Running a business is never easy, and for diverse business owners, securing funding can often feel like an uphill battle. According to a study by the Minority Business Development Agency, diverse-owned businesses are more likely to be denied loans, receive smaller amounts when approved, and face higher interest rates. In challenging economic times, this disparity can feel even more pronounced. But tough times also call for creative solutions.

If you’re a diverse business owner looking to grow your business despite funding hurdles, here are 10 innovative ways to secure the capital you need.

1. Tap Into Grants for Diverse-Owned Businesses

Grants are a powerful, debt-free way to secure funding. Organizations like Hello Alice!, the National Association for the Advancement of Colored People, Support Latino Business, and the Small Business Administration provide grant programs tailored to diverse-owned businesses. Regularly checking online grant directories such as Grants.gov can help you stay informed.

When applying for grants, tailor your application to align with the grant’s mission, showcasing how your business contributes to your community or industry.

2. Leverage Crowdfunding Platforms

Platforms like Kickstarter, GoFundMe, and iFundWomen enable you to raise capital while building brand awareness. Crowdfunding also serves as a way to validate your product’s market demand.

How to Stand Out:

- Create an engaging video that tells your story.

- Offer compelling rewards for contributors.

- Use social media to drive traffic to your campaign.

3. Seek Out Angel Investors and Venture Capital

Angel investors and venture capitalists are often eager to support businesses with high growth potential. Organizations like Backstage Capital specialize in funding diverse founders. To succeed, craft a strong pitch that highlights your market opportunity, financial projections, and unique value proposition.

Attend pitch competitions and networking events to connect with potential investors.

4. Partner With Larger Companies

Corporate partnerships can provide not just funding but also resources and mentorship. Many corporations have supplier diversity programs aimed at supporting minority-owned businesses. Explore partnerships with companies in your industry that align with your values and goals.

For example, if you’re in manufacturing, look for large companies seeking diverse suppliers for components or services.

5. Apply for Low-Interest Loans and Microloans

The SBA’s Community Advantage program and organizations like Accion Opportunity Fund offer microloans specifically for small businesses. These loans typically have lower interest rates and flexible terms.

If you’re looking at loans, make sure to prepare a comprehensive business plan and financial statements to increase your chances of approval.

6. Utilize Revenue-Based Financing

Revenue-based financing allows you to repay investors as a percentage of your monthly revenue, making it ideal for businesses with seasonal or fluctuating income. Platforms like Lighter Capital specialize in this type of funding.

With revenue-based financing, you’re not locked into a fixed repayment schedule, reducing financial strain during slower months.

7. Collaborate With Local Economic Development Programs

Many cities and states have economic development programs designed to support small and diverse businesses. These programs often provide funding, training, and networking opportunities.

Check with your local chamber of commerce or minority business association to discover available resources.

8. Launch a Subscription Model

Subscription-based services can create a steady stream of revenue, which can be attractive to investors. Whether it’s a product-of-the-month club or exclusive member benefits, subscriptions provide consistent income.

Use platforms like Patreon or Substack to monetize content, or integrate subscription services into your existing product line.

9. Bootstrap Strategically

Bootstrapping—using your own funds or reinvesting profits—can be challenging, but it gives you complete control over your business. Look for ways to reduce costs, such as co-working spaces or outsourcing non-essential tasks.

Creative Ideas:

- Barter services with other small businesses.

- Negotiate longer payment terms with suppliers.

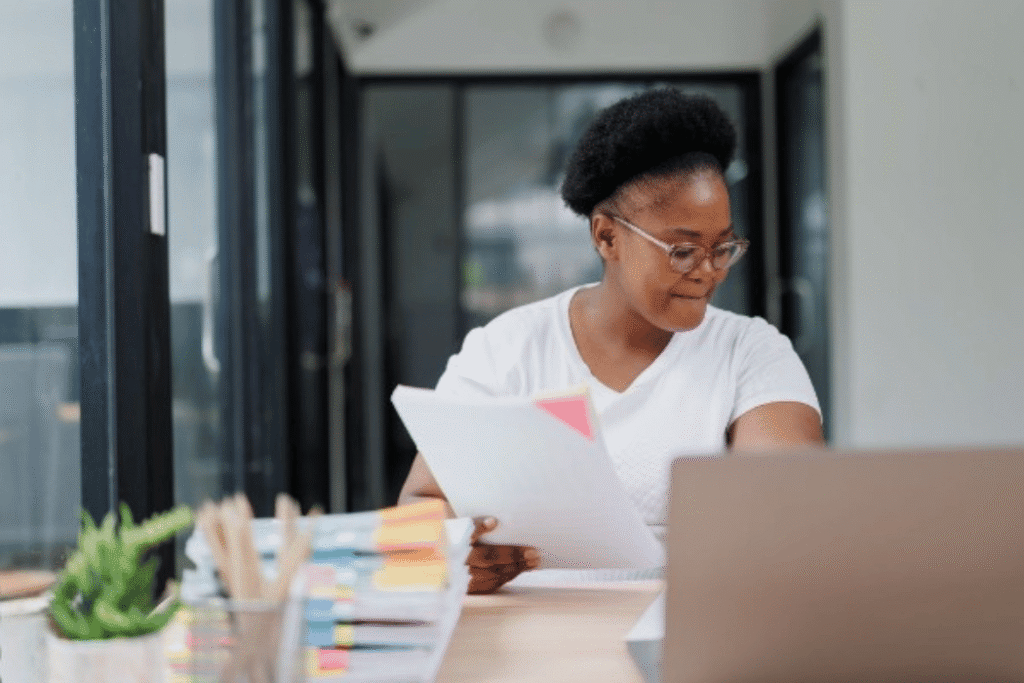

10. Build a Strong Personal and Business Credit Profile

Lenders and investors look at your credit history to assess risk. Strengthen your credit by paying bills on time, keeping debt low, and diversifying your credit mix. Tools like Credit Karma can help you monitor and improve your score.

Establish a business credit profile by registering for a DUNS number and opening a business credit card.

Embrace Creativity and Resilience

Funding challenges are real, but so is the resourcefulness of diverse entrepreneurs. By leveraging a mix of traditional and innovative funding methods, you can secure the capital you need to grow and thrive—even in tough times.

Start by evaluating your business needs and researching which options align with your goals. Remember, every step you take not only strengthens your business but also paves the way for other diverse entrepreneurs to follow.