Often as a founder, you may have everything you need to launch and run a successful business except the one thing that you need most: startup capital. And you’re like to discover what millions of diverse business owners know too well, traditional funding can be incredibly hard to access.

The statistics are eye-opening. According to the 2023 Annual Business Survey, minority entrepreneurs now own 1.3 million businesses with employees, that’s 22.6 percent of all employer firms in America. Yet these same entrepreneurs face a massive funding gap. Only 28 percent of businesses started by people of color obtain business loans, compared to 48 percent of white-owned startups.

Here’s where grants become game-changers. Unlike loans, grants don’t require repayment. They’re designed specifically to level the playing field and give minority entrepreneurs the resources they need to build successful businesses.

In 2025, more grant opportunities exist for minority entrepreneurs than ever before. From federal programs offering millions in funding to corporate initiatives supporting diversity, the landscape has expanded dramatically. This guide covers 10 of the most accessible and impactful grants available right now, including current application deadlines, eligibility requirements, and insider tips to help you win.

The Funding Gap and Why Diverse Entrepreneurs Need Grants

The funding gap between diverse and white-owned businesses isn’t just about numbers, it’s about missed opportunities and unrealized potential. Traditional banks and investors often have unconscious biases that make it harder for diverse entrepreneurs to access capital.

But grants change the game completely. Here’s why they’re so important:

No Repayment Required. Unlike loans, grants are free money. You don’t have to worry about monthly payments or interest rates eating into your profits.

Credibility Boost. Getting a grant isn’t just about the money. It shows other investors and customers that your business has been vetted and approved by serious organizations.

Networking Opportunities. Many grants come with mentorship programs, training, and connections to other successful business owners.

Growth Focused. Grant money can be invested directly into growing your business, whether that’s hiring employees, buying equipment, or expanding to new markets.

Top Federal and Nationwide Grants for Minority Businesses

The federal government offers some of the biggest and most reliable funding opportunities for diverse entrepreneurs. These grants typically offer larger amounts of money and have clear, consistent application processes.

1. Minority Business Development Agency (MBDA) Technical Assistance Grants

The MBDA kicked off 2025 with $11 million in federal funding competitions for technical assistance to support entrepreneurs. However, it’s important to understand that MBDA funds third-party organizations that provide services in support of the Agency’s mission to promote the growth and global competitiveness of minority business enterprises (MBEs).

Who Can Apply: Organizations apply for these grants to provide services to minority entrepreneurs, not individual businesses directly.

How to Access: Work with MBDA Business Centers and partner organizations that have received these grants.

Grant Focus: Programs that serve rural minority businesses, advance women’s entrepreneurship, and elevate the next generation of entrepreneurs.

Best For: Entrepreneurs who want technical assistance, business counseling, and access to networks rather than direct funding.

2. Small Business Innovation Research (SBIR) & Small Business Technology Transfer (STTR)

These programs are perfect for diverse entrepreneurs in technology, healthcare, energy, and other innovative fields. As of October 2024, agencies may issue a Phase I award (including modifications) up to $314,363 and a Phase II award (including modifications) up to $2,095,748.

Who Can Apply: Small businesses with fewer than 500 employees working on innovative technology solutions.

Grant Amounts: Phase I awards up to $314,363, Phase II awards up to $2,095,748.

How to Apply: Through individual federal agencies like NASA, NIH, NSF, and others.

Best For: Tech startups, healthcare innovations, renewable energy companies, and research-focused businesses.

3. Community Development Financial Institutions (CDFI) Program Grants

CDFIs are local organizations that specialize in providing capital to underserved communities. These grants help CDFIs, which then provide funding to diverse entrepreneurs in their communities.

Who Can Apply: While entrepreneurs don’t apply directly, you can work with local CDFIs that have received these grants.

Grant Amounts: CDFIs typically offer loans and grants ranging from $5,000 to $500,000.

How to Find Them: Search for CDFIs in your area through the CDFI Fund website.

Best For: Local businesses that serve their communities, especially in rural or low-income areas.

Big Brands Supporting Diverse Entrepreneurs

Corporations have recognized that supporting diverse-owned businesses isn’t just good for society—it’s good for business. Many major companies now offer grants specifically for diverse entrepreneurs.

4. FedEx Small Business Grant Contest

FedEx runs an annual contest that awards grants to small businesses.

Who Can Apply: Small businesses that have been operating for at least six months.

Grant Amounts: Typically ranges from $7,500 to $25,000, plus business services.

How to Apply: Submit a business pitch through their website during the contest period (usually spring/summer).

Best For: Businesses that can clearly explain their growth plans and community impact.

5. Comcast RISE Grants

Comcast RISE (Representation, Investment, Strength, and Empowerment) continues to support diverse-owned businesses in 2025. The program awarded 500 grants in 2024 and applications for 2025 have closed (May 1-31, 2025), with awards announced in August 2025.

Who Can Apply: Small businesses that have been established for 2+ years, have 100 or fewer employees, and are independently owned.

Grant Amounts: $5,000 cash grants plus technology makeovers, creative production services, media schedules, and business consultation.

How to Apply: Applications typically open in May through ComcastRISE.com.

Best For: Established businesses (2+ years) that need both funding and comprehensive business services like marketing and technology support.

6. Wells Fargo Open for Business Fund

Wells Fargo has continued its commitment to supporting diverse businesses through various community development initiatives and partnerships with CDFIs and community organizations.

Who Can Apply: Small businesses, particularly those in low-to-moderate income communities.

Grant Amounts: Varies by program and partner organization.

How to Apply: Through participating community development financial institutions (CDFIs) and community organizations.

Best For: Established businesses working with local community development organizations and seeking both capital and technical assistance.

Philanthropic Funds Helping Diverse Founders Thrive

Nonprofit organizations and foundations often have more flexible requirements and can provide funding for businesses that might not qualify for government grants.

7. NAACP Powershift Entrepreneur Grant

NAACP believes in the power of Black entrepreneurship. It partners with several organizations to provide grants for Black-owned businesses. Less than 5 percent of American business owners are Black.

Who Can Apply: Black entrepreneurs across all industries.

Grant Amounts: Varies by program, typically $1,000 to $10,000.

How to Apply: Through the NAACP website and partner organizations.

Best For: Early-stage Black-owned businesses that need startup capital.

8. National Association for the Self-Employed (NASE) Growth Grants

NASE offers grants to help small business owners grow their companies, with opportunities specifically for diverse entrepreneurs.

Who Can Apply: NASE members who have been in business for at least one year.

Grant Amounts: Up to $4,000.

How to Apply: Online application through the NASE website.

Best For: Solo entrepreneurs and very small businesses looking to make specific improvements or purchases.

9. Asian Women Giving Circle Grants

This organization focuses specifically on supporting Asian American women entrepreneurs who are working on social justice and cultural initiatives.

Who Can Apply: Asian American women entrepreneurs with businesses that advance social justice, culture, or community development.

Grant Amounts: Typically, $2,500 to $15,000.

How to Apply: Through their website during application periods.

Best For: Asian American women entrepreneurs working on community-focused or social impact businesses.

10. The Cartier Women’s Initiative

While not exclusively for minorities, this global competition strongly encourages applications from diverse entrepreneurs and provides significant funding and support.

Who Can Apply: Women entrepreneurs from around the world, with strong encouragement for diverse applicants.

Grant Amounts: $100,000 for winners, plus $30,000 for finalists.

How to Apply: Annual application process through their website.

Best For: Women-led businesses with high growth potential and social impact.

Community-Based Grants You Shouldn’t Overlook

Don’t forget to look close to home. State and local governments often have grants specifically designed to support diverse entrepreneurs in their communities.

Many states have their own minority business development programs.

To find opportunities in your area:

- Check your state’s economic development website

- Contact your local chamber of commerce

- Visit small business development centers

- Look into city and county grant programs

These local programs often have less competition than national grants, making your chances of success higher.

How to Apply (and Win) Diverse Entrepreneur Grants

Getting grant money isn’t just about filling out forms. Here’s how to make your application stand out:

Be Clear About Your Impact

Don’t just say your business will be successful. Explain exactly how it will help your community, create jobs, or solve important problems. Use specific numbers whenever possible.

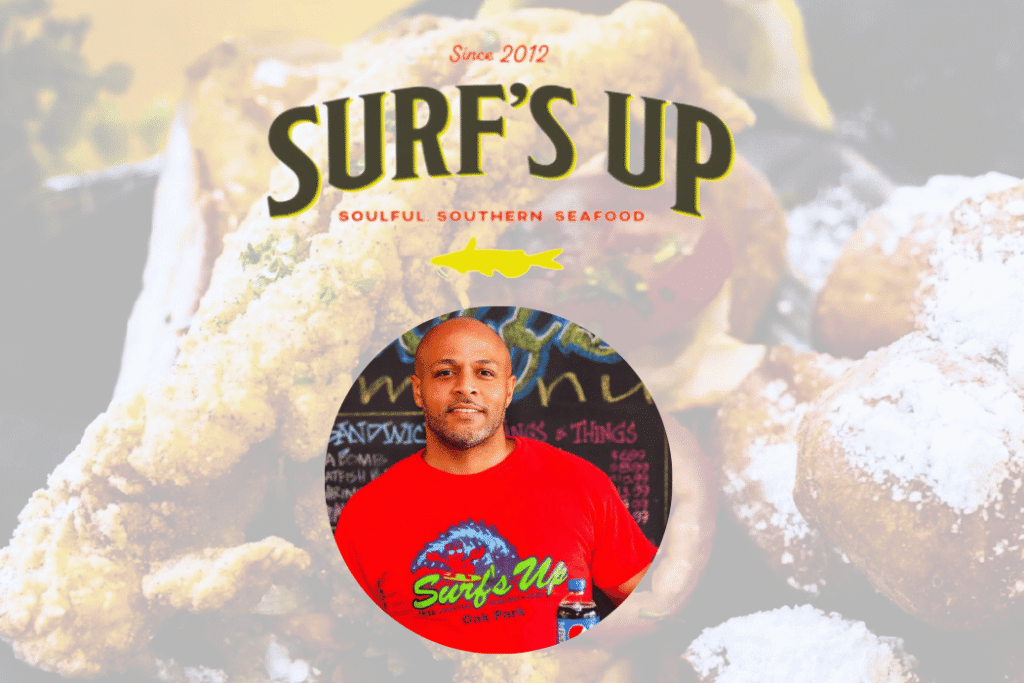

Instead of: “Our restaurant will serve the community.” Try: “Our restaurant will create 15 jobs and provide healthy, affordable meals in a food desert that currently has no full-service restaurants within 3 miles.”

Use Data to Show Market Potential

Grant funders want to see that you understand your market and have realistic growth plans. Include:

- Market size and growth trends

- Your target customers

- Competition analysis

- Revenue projections

Highlight Community Benefit and Job Creation

Many grants prioritize businesses that will benefit the broader community. Show how your business will:

- Create jobs for local residents

- Serve underserved communities

- Support other diverse-owned businesses

- Contribute to local economic development

Tell Your Authentic Story

Your personal story as a diverse entrepreneur is powerful. Explain:

- What inspired you to start your business

- Challenges you’ve overcome

- How your background gives you unique insights

- Why you’re passionate about your work

Prepare Required Documents

Most grant applications require:

- Business plan

- Financial statements or projections

- Tax returns (if your business is already operating)

- Proof of minority ownership

- Letters of support from customers or community leaders

Pro Tip: Many grants require certification as a diverse-owned business through organizations like the National Minority Supplier Development Council (NMSDC) or the Women’s Business Centers. Get certified before you start applying.

Turning Grants Into Growth

Getting the grant is just the beginning. Here’s how to make the most of your funding:

Invest in Growth, Not Just Expenses

Don’t just use grant money to pay bills. Use it strategically to grow your business:

- Marketing campaigns to reach new customers

- Employee hiring to increase capacity

- Technology upgrades to improve efficiency

- Inventory expansion to serve more customers

- Equipment purchases to boost productivity

Track Your Results

Many grants require reports showing how you used the money and what results you achieved. But even if reporting isn’t required, tracking your results helps you:

- Apply for future grants more successfully

- Make better business decisions

- Show other investors your track record

Build Relationships

The organizations that give you grants often become long-term partners. Stay in touch with them, attend their events, and look for additional opportunities to work together.

The Path Forward for Diverse Entrepreneurs

Grants aren’t just funding—they’re tools for visibility, growth, and equity. They represent recognition that minority entrepreneurs bring unique value to the economy and deserve support to succeed.

Black business owners own 3.5 million businesses and employ more than 1.2 million people. This represents an annual increase of over 7 percent in people employed by Black entrepreneurs. This growth shows that when minority entrepreneurs get the resources they need, they create jobs and drive economic growth.

Remember these key points as you move forward:

- Apply Widely. Don’t put all your hopes on one grant. Apply to multiple opportunities to increase your chances.

- Stay Consistent. Grant applications take time and effort. Make it a regular part of your business development process.

- Use Available Resources. Organizations like MBDA centers, SCORE, and chambers of commerce offer free help with applications and business planning.

- Network Actively. Connect with other minority entrepreneurs who have successfully received grants. They can provide valuable advice and introductions.

The funding landscape for minority entrepreneurs is better today than it’s ever been. New grant programs are launching regularly, and existing programs are expanding their reach. Major corporations, government agencies, and nonprofit organizations all recognize that supporting diverse businesses benefits everyone.

Your business idea deserves a chance to succeed. These grants can provide the fuel to turn your vision into reality. Don’t let lack of funding be the thing that stops you from building the business of your dreams.

Take action today: Pick three grants from this list that fit your business. Visit their websites, mark application deadlines on your calendar, and start preparing your materials. Your future success is waiting—you just need to reach out and grab it.