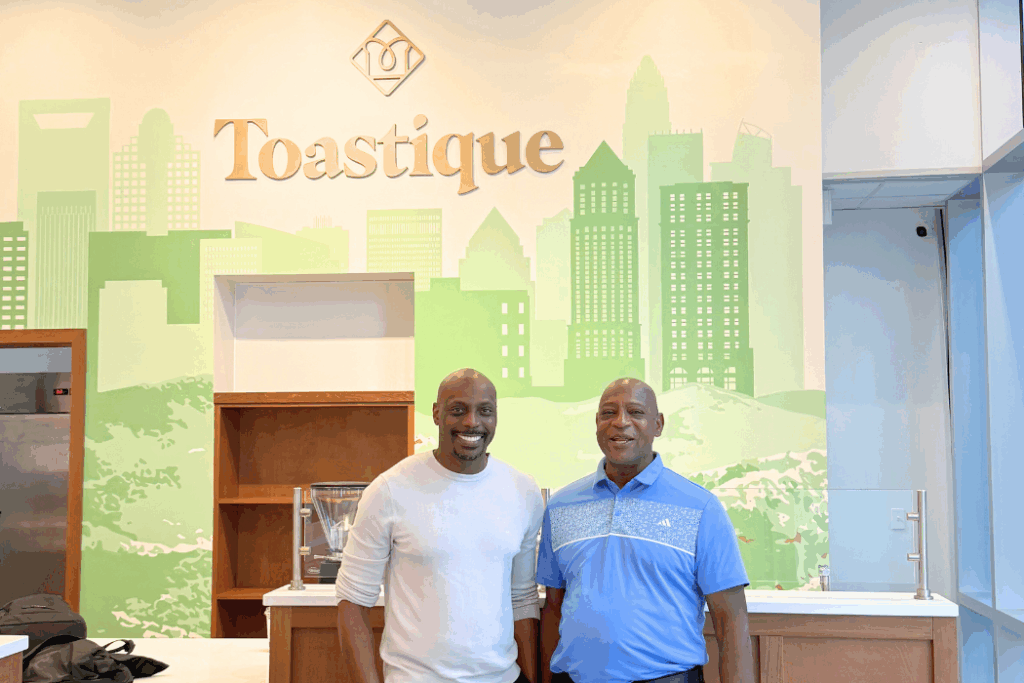

The path to financial success for Black and brown business entrepreneurs is not linear. It’s a path filled with many peaks and valleys. Recently, I had the opportunity to sit down with a group of creative entrepreneurs to discuss their thoughts on personal finance and building wealth.

In this article, you’ll find a summary of the key insights from our discussion, highlighting the obstacles these business owners face and the lessons other entrepreneurs can learn to navigate their financial journeys more effectively.

Gaps in Financial Knowledge

A recurring theme in our conversation was the significant gap in financial literacy among the business owners. Despite your entrepreneurial spirit and dedication, you may lack the essential knowledge to manage your business and personal finances – particularly as you grow and scale. Among those who took part in the discussion, this gap is particularly evident in areas such as tax planning, retirement savings, and long-term wealth building.

Recently, I’ve been watching social media clips of successful business owners who once struggled financially. When asked what their biggest challenge was most responded with not properly managing cash flow. Lack of capital and not managing cash flow are the primary causes behind many businesses failing in the first 18-months. Fifty percent of Black-owned businesses fail in their first five years. Because of these startling statistics, I wanted to expose what may be some of the causes through the story of others.

Nichole Taylor, a veteran PR and marketing consultant, shared her disinterest in finance, a sentiment echoed by many in the group. She expressed anxiety about managing her business finances and admitted to doing the bare minimum to get by. This reluctance to engage with financial matters is common and often leads to missed opportunities for growth and optimization. If numbers, budgets, and financial decisions are hard in your personal life, this typically carries over into your business life. It presents a gap that you should consider filling with someone who is passionate about those areas.

The Importance of Financial Education and Networking

The group of entrepreneurs underscored the need for comprehensive financial education tailored to the unique challenges faced by Black and brown business owners. Nichole emphasized the role of minority business councils, magazines, masterminds, etc., in providing valuable resources and networking opportunities. These platforms can help entrepreneurs connect with financial experts and peers who have successfully navigated similar challenges.

Networking at events and within professional communities can also open doors to valuable advice and mentorship. Betsy Helgager Hughes, the owner of 23-year-old BLH Consulting, Inc., a marketing and PR consulting business, highlighted the benefits of sharing insights on wealth development and management, fostering a collaborative environment where business owners can learn from each other’s experiences.

Entrepreneurship and Wealth Building

The entrepreneurs I talked to came from diverse backgrounds, each with unique stories of perseverance and innovation. Renard Beaty of Atlanta-based Kick Start Martial Arts, who has been in business for ten years, is contemplating the future of his martial arts studio as he begins to think about exit and succession planning. Alejandra Cádiz Gómez, with 25 years of experience in public relations and marketing, is planning for retirement in five years and seeks effective strategies from her financial advisor to ensure a smooth transition.

LeAnna Lynn shared her journey from corporate jobs to owning a restaurant, emphasizing the importance of financial literacy for her children’s future. This highlights a critical aspect of wealth building: the need to pass down financial knowledge to the next generation, ensuring they are better prepared for financial success.

Financial Planning and Tax Strategies

Effective financial planning and tax strategies are crucial for business owners to maximize their wealth and reduce their tax liability. However, many entrepreneurs struggle with these aspects. Nichole Taylor views taxes as a necessary evil that can drain the bottom line if not managed properly, while LeAnna Lynn prioritizes profitability over deductions to position herself for loan access from investors to scale.

Our discussion revealed several actionable steps business owners can take to improve their financial standing:

- Bookkeeping: Hiring a bookkeeper to manage business books and provide reports to a CPA can streamline financial management, help manage cash flow, and ensure accuracy.

- Business Structure: Revisiting the business entity structure and considering converting to an S-corp can offer tax advantages and operational benefits.

- Estate Planning: Ensuring estate planning (with buy-sell agreements for business owners) for children benefiting from the business is essential for long-term security and wealth transfer.

- Consultation: Scheduling consultations with financial advisors and tax strategists can provide personalized advice and strategies tailored to specific business needs.

The Role of Financial Advisors & Tax Strategists

Another one of the key takeaways from our discussion was the importance of seeking professional financial advice early in the business journey. Financial advisors can guide business owners on managing their money to generate more income, optimizing investments, and implementing effective tax strategies.

However, identifying the right advisor can be challenging. Every advisor has a different approach to financial planning, different strengths, and different experiences. Some advisors only work with business owners and some only work with W-2 employees. It’s important to ask a lot of questions when you are interviewing an advisor. Ask if they have ever worked with clients in your industry, understand the nuances of brick and mortar businesses vs home-based service businesses, their communication style, and whatever else is important to you. Also, be comfortable knowing that the person you hire today may not be alongside you for years to come. As your business grows and scales, your challenges and needs will change. It’s okay to seek new guidance as you continue to elevate personally and professionally.

Conclusion

Overall, the insights from our discussion highlight the critical need for financial education, transparency, and proactive planning among minority business owners. By addressing gaps in knowledge, leveraging networking opportunities, and seeking professional advice, entrepreneurs can build a solid foundation for financial success and long-term wealth.

As a financial advisor and tax strategist, I encourage you to take these lessons to heart and seek out guidance sooner rather than later. Sometimes we fall into a space where we think ‘we can’t afford it’, but I believe that mindset is holding you back. It comes from a place of scarcity and not from abundance.

In addition, I challenge you to think about the cost of not investing in the success of your business, which is directly tied to the financial stability of your family. When I asked the group of entrepreneurs why they entered entrepreneurship, the overwhelming response was for ‘freedom’. Really think about the financial cost of your freedom. What are you giving up or leaving behind by not investing in systems, people, advisors, etc., to help support you so that you can achieve the true freedom of your entrepreneurial spirit and the security of your financial dreams.