BCH’s AMEN Corner – Affluent Minority Entrepreneur News

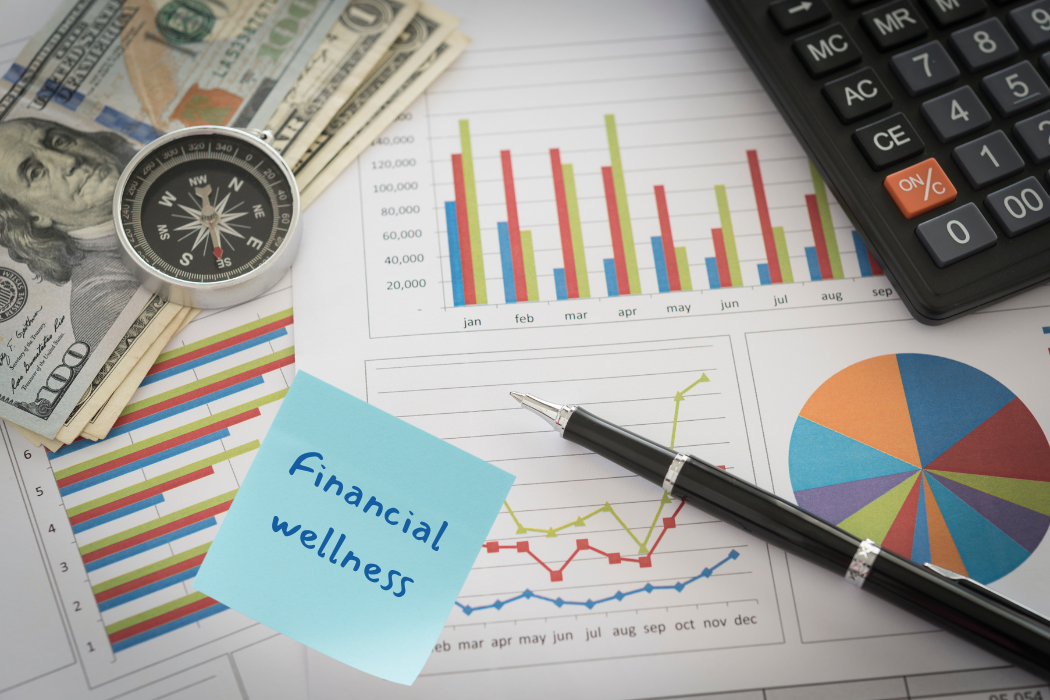

We talk a lot about capital when it comes to minority business success: access to loans, venture funding, grants, and supplier contracts. And while these conversations are critical, they often skip over something even more foundational—financial wellness for the business owner.

Behind every thriving business is a person navigating complex, high-stakes financial decisions—both professionally and personally. Yet many minority entrepreneurs are building businesses while carrying personal debt, supporting extended families, lacking retirement plans, or feeling overwhelmed by financial stress.

This quiet crisis is undermining growth from the inside out.

The Overlap Between Personal and Business Finance

Entrepreneurs often blur the lines between their personal and business finances. In the early stages of business, this overlap is almost unavoidable. Founders bootstrap using personal savings, tap into personal credit cards, or skip a salary for months on end. But without strong financial mastery and support systems, these decisions can become long-term liabilities.

It’s not uncommon for minority business enterprise (MBE) founders to:

- Take out high-interest loans without fully understanding repayment terms.

- Forgo personal retirement savings in order to invest in their business.

- Use personal credit to cover business shortfalls, potentially hurting their credit score.

- Miss out on tax strategies that could preserve wealth and lower their burden.

These choices aren’t due to irresponsibility—they’re due to lack of access to education, financial guidance, and advisors who understand the dual pressures of being both a founder and a family financial anchor.

Why Financial Wellness Should Be a Business Strategy

When founders are financially unwell, their businesses are vulnerable. Chronic stress reduces clarity, limits strategic decision-making, and leads to reactive rather than proactive behavior. On the flip side, when entrepreneurs are equipped with strong financial foundations, they’re more confident, decisive, and positioned for long-term success.

Financial wellness for founders includes:

- Understanding personal and business cash flow and how to separate them.

- Creating emergency savings so personal crises don’t derail business operations.

- Setting up retirement plans, even for solo founders, to build long-term wealth.

- Learning tax planning strategies to minimize liabilities.

- Developing boundaries around compensation, so owners aren’t the last to get paid.

The Racial Wealth Gap Is Part of the Conversation

We can’t talk about financial wellness without acknowledging the structural gaps. Due to generations of discrimination in lending, housing, and employment, many minority entrepreneurs start without generational wealth, home equity, or family safety nets. They are often “firsts”—first in the family to own a business, to earn six figures or higher, or to navigate complex tax filings or business strategies.

This makes financial knowledge not a “nice to have,” but a necessary tool for building stability and legacy.

Where to Start: Practical Steps

If you’re a founder or support MBEs in your work, here are a few steps to integrate financial wellness into your strategy:

- Create a Founder Financial Plan: Just as your business has a budget, so should you. Understand your personal financial needs, goals, and debt obligations.

- Separate Business and Personal Finances: Open dedicated business accounts. Pay yourself regularly, even if it’s modest at first.

- Work With a Culturally Competent Financial Advisor: Seek out professionals who understand your values, your goals, and your lived experience.

- Incorporate Wellness Into Your Business Culture: Encourage your team to build their own financial wellness. Consider hosting workshops or partnering with local organizations.

- Talk About It: We need to normalize financial vulnerability in entrepreneurial spaces. Sharing stories, challenges, and lessons can help reduce stigma and open doors to resources.

Final Thought

We can’t talk about scaling, wealth building, or economic equity for minority-owned businesses without including the personal financial health of the people leading them. Financial wellness isn’t a luxury—it’s infrastructure. And when MBE founders are well, their businesses, families, and our communities are far stronger for it.