According to Alliance for Entrepreneurial Equity (AEE), “Entrepreneurial success is one of the greatest drivers of wealth creation and must be at the center of any national effort to create racial equity and expand economic opportunity.” However, it is clear that many minority-owned businesses face significant challenges and require tailored advice. We now know that many business owners from diverse backgrounds have not previously established useful connections, limited access to capital, and in most cases, revenues that may be below those of their counterparts.

The AEE has looked more closely at the problems at hand for minority-owned businesses and the evidence is eye-opening. To start, minority-owned businesses are far smaller with only 2 percent of businesses with employees are Black-owned, 6 percent are Hispanic-owned, 10 percent are Asian-owned, and 0.4 percent are American Indian- and Alaska Native-owned. Also, Black-owned businesses were four times more likely to have revenue under $100,000 than white-owned businesses. They are also three to five times more likely to be labeled a high credit risk. White-owned businesses are two to three times more likely to receive all their financing compared to Black- and Hispanic-owned businesses. And, women-owned small businesses only receive 5 percent of federal contracts and minority-owned only have 4 to 10 percent.

Digging into the details

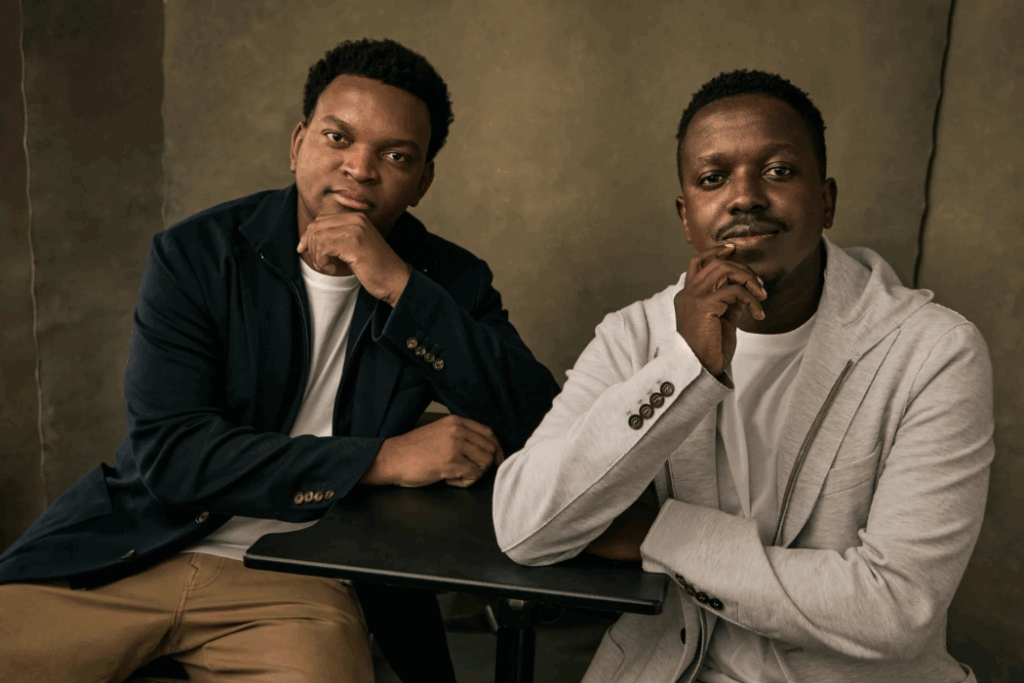

My son, brother, nieces and nephews, uncles and aunts, are from diverse backgrounds and many are entrepreneurs. When I look at a minority or female founder, I embrace them as family. Becoming a trusted advisor in the minority and women founder arena has involved really getting into the weeds and understanding the barriers that minority- and female- founded businesses face.

As a BIPOC (black, indigenous, person of color) financial advisor, I’ve dedicated a substantial amount of time researching relevant information with third-party certifying agencies, sharpening technical knowledge regarding the various exit strategies, identifying resources available to accelerate revenue, and spending quality time with successful business owners themselves who are paving the way for others to follow in their path. CEPA®s advise business owners throughout their business lifecycle and while founders focus on the day-to-day operations, advisers focus on how those decisions impact both the personal and business balance sheet.

No “one size fits all” approach is available to solve the issues that have negatively impacted the sustainability of minority-owned businesses. However, it is important to know as there are now many programs and resources available for minority-owned business owners.

The role of certification and supplier diversity in the MBE and female business ecosystem

The first step that new minority- and female-owned business owners should take is to certify as a minority-owned business or MBE. To qualify as a MBE with the National Minority Supplier Development Council (NMSDC) or a local MBE program administered by a city, county or state, here’s the criteria:

- The entity must be a for-profit business located in the United States;

- It must be 51 percent owned, operated, capitalized and controlled by a member of a presumed group identified as a minority, who is the top executive officer responsible for managing daily operations with a technical expertise (experience) in the firm’s primary business expertise; and

- It must be owned by United States citizens.

The NMSDC has a network of 12,000 certified minority-owned businesses that can then be connected to more than 1,400 large corporate members. According to the U.S. Chamber of Commerce, “corporate membership of NMSDC includes many of the largest privately owned companies in the world, including Accenture, Apple, Bank of America, Delta Airlines, Facebook, Google, GM, Microsoft, Nike, Raytheon, UnitedHealth Group, Walmart and Walt Disney Company. These member companies use the NMSDC directly for minority-owned businesses to research companies and award contracts.”

After certification, it’s important MBE’s learn more about supplier diversity programs, which were established more than 50 years ago by the federal government with a goal to encourage the use of vendors owned by underrepresented populations. Over time, the business case for supplier diversity has become more and more clear as increased innovation with different solutions based on new perspectives as well as companies have the benefit of building a reputation in diverse communities. Also, as many vendors are also company customers, it’s strategic to help build community wealth, which enhances customer relationships.

For a minority- and woman-owned business to reap the benefits of the funds available for spend via supplier diversity programs, there are a few best practices to implement:

- Evaluating Scale – A business must determine if its bandwidth or scale is suitable for local, regional, or national partnerships with corporations. Alignment of scale and capability from the vendor to needs of the partner organization is critical for the business to be successful in obtaining corporate or government contracts.

- Having Access – Most corporations who have a supplier diversity program also have a supplier diversity portal where the business can create a profile. This profile will need to outline the capabilities of the company, revenue, staff count, any applicable third-party diversity certifications, etc. When the corporation has an opportunity to initiate a RFP (request for proposal), their supplier diversity team will pull MBE candidates from the profiles in the portal that align with the need. The key here is to register in the portal to make sure you can be considered.

- Becoming Certified – As discussed, certification as a minority-owned company or woman-owned company can significantly increase their visibility and opportunities as most suppliers’ diversity programs only report spending with certified diverse suppliers. There are a multitude of third-party certification agencies available to validate their diversity. Find the agency that best suits you and get actively involved.

Advisors in this ecosystem require a lot of technical knowledge and relationships with key individuals within the systems that support these diverse founders and their initiatives. It’s important for MBE business owners to take advantage of all available options, ask the tough questions and seek out advice to avoid pitfalls along their business journey.

Sheila Simmons, Vice President and Financial Advisor with the Executive Wealth Partners at UBS Financial Services Inc.