Financial expert reveals hidden costs and protection strategies

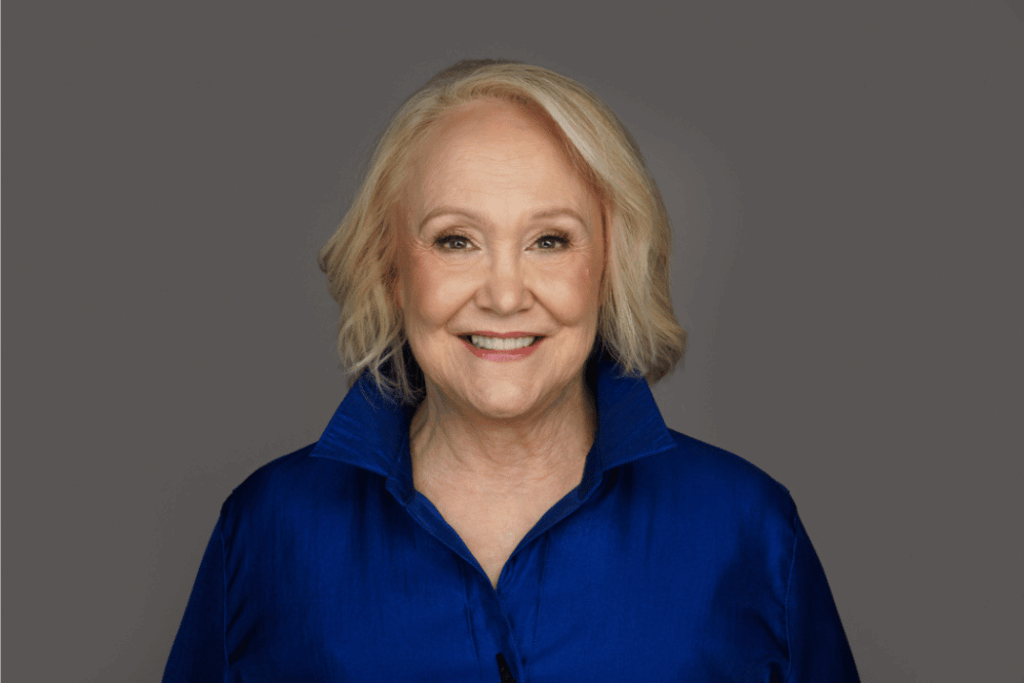

As President Donald Trump takes executive action to impose sweeping new tariffs on America’s largest trading partners, small businesses and consumers brace for impact. Financial expert Hyacinth Henderson, founder of the Henderson Financial Group, breaks down the ripple effects of these tariff increases and offers practical strategies for both business owners and consumers to stay ahead of the economic curve.

Understanding Trump’s New Tariff Measures

The latest executive action declares an economic emergency, imposing:

- 10 percent duties on all imports from China

- 25 percent duties on imports from Mexico and Canada

- 10 percent tax on Canadian energy imports (oil, natural gas, and electricity)

While Mexico and Canada have negotiated a 30-day reprieve through agreements on border security and drug trafficking efforts, the Chinese tariffs are set to take effect immediately. These measures target a wide range of products essential to American businesses and consumers:

- Oil and lumber from Canada

- Plastics, textiles, and computer chips from China

- Produce, clothing, liquor, and auto parts from Mexico

The Hidden Trickle-Down Effect of Tariffs

“When the big guys are fighting, someone always ends up paying the price—and it’s usually not them,” Henderson explains, addressing the complex implications of these international trade disputes. She points to a simple but sobering reality: major corporations rarely absorb increased costs from tariffs. Instead, these expenses cascade down to everyday consumers and small business owners.

The impact shows up in unexpected places:

- Your usual $1,000 business electronics purchase might jump to $1,500 due to tariffs on Chinese computer components

- Grocery bills climb higher as Mexican produce faces new duties

- Gas prices increase due to affected imports from both Mexico and Canada

- Essential business supplies become more expensive across the board

“What I want you to imagine,” Henderson emphasizes, “is that you’re sitting here minding your business, and all of sudden, the money in your pocket is shrinking.”

Three Immediate Actions for Financial Protection

Given the imminent implementation of these tariffs, Henderson advocates for urgent financial planning with three crucial steps:

1. Know Your Numbers Inside Out

“You need to know your numbers like the back of your hand,” Henderson insists. This becomes even more critical as businesses face potential price increases across multiple supply chains. She recommends setting up regular “money dates”—at least twice monthly—to review financial statements and track profitability.

2. Cut Unnecessary Expenses Now

With tariffs threatening to increase costs across multiple sectors, Henderson advises conducting a thorough review of all expenses, particularly those on auto-pay. “Often, we signed up for things years ago… and because it’s on auto-pay, we don’t realize that money is still coming out of our accounts.”

3. Reinvest Savings Strategically

Instead of pocketing the savings from cost-cutting measures, Henderson recommends reinvesting them. “I want you to put that money in a place so that it circulates and makes more money for you,” she explains. This creates a financial buffer against the incoming wave of price increases.

Investment Strategies for Economic Uncertainty

While Henderson maintains professional discretion about specific investment advice, she shares valuable insights about diversification strategies during this period of trade tension:

- Consider various investment classes that often have inverse relationships

- Look into stocks, ETFs, and mutual funds

- Explore real estate opportunities

- Research precious metals like gold

- Start investing with any amount – don’t wait for large sums

“The stock market did 24 percent last year,” Henderson notes, emphasizing that despite economic uncertainties, opportunities exist for those who act strategically.

Special Considerations for Minority and Women-Owned Businesses

For businesses heavily reliant on imported materials from China, Mexico, or Canada, Henderson emphasizes the importance of building community connections and diversifying supplier relationships. “Start looking for alternative resources within your community now,” she advises. This proactive approach helps prevent crisis situations when the full impact of tariffs hits.

Building Long-Term Financial Resilience

Henderson’s approach to long-term financial security centers on two key strategies:

- Build Your Reserves: Move beyond the paycheck-to-paycheck or client-to-client cycle by establishing what Henderson calls a “set-aside account.”

- Optimize Tax Strategies: “95 percent of business owners are leaving money on the table,” Henderson reveals, emphasizing the importance of working with tax professionals to maximize cash flow during these challenging trade conditions.

Taking Action Today

The key message throughout Henderson’s advice is clear: don’t wait for these tariff changes to force your hand. “The best time to invest is right now,” she emphasizes. “The dollar today that you have is going to be worth less tomorrow.”

For those ready to take control of their financial future amid these trade uncertainties, Henderson offers support through her firm, The Henderson Financial Group, a family-owned business with over 30 years of experience. As a licensed and registered investment advisor, she specializes in helping clients build wealth beyond six-figure incomes.

To learn more about protecting your business and personal finances from the impact of these new tariffs, visit thehendersonfinancialgroup.com or find Hyacinth Henderson on YouTube for additional insights and strategies.

Remember, in this rapidly evolving trade environment, the best defense is a good offense—and that means starting your financial protection strategy today.

For more insights, listen to our full conversation with Hyacinth Henderson.

Advisory services are offered through SB Advisory, LLC and San Blas Advisory, LLC. SB Advisory, LLC and San Blas Advisory, LLC are Registered Investment Advisers with the United States Securities and Exchange Commission (SEC).