Small business advocates like CAMEO Network’s Carolina Martinez continue to champion entrepreneurial resilience during National Small Business Week

As National Small Business Week (May 4-10) unfolds across the United States, small business owners find themselves navigating unprecedented economic challenges. Budget cuts to critical support programs, rising operational costs, and tightening loan standards have created a perfect storm of uncertainty. Yet, according to Carolina Martinez, CEO of small business advocacy group CAMEO Network, entrepreneurs continue to demonstrate remarkable resilience in these turbulent times.

The State of Small Business in 2025

“This year has been one that has really tried and challenged how to run businesses, especially for small business owners and entrepreneurs of color in the under-resourced community,” Martinez explains. Her organization, which has built a network of nearly 450 organizations over 30 years, serves as a vital lifeline for entrepreneurs seeking guidance, capital, and advocacy.

Many small business owners report experiencing uncertainty, fear, and even dread about current market conditions. However, Martinez notes that despite these challenges, most remain cautiously optimistic and committed to growth.

Budget Cuts Threaten Essential Small Business Resources

The current administration’s proposed budget has raised serious concerns among small business advocates. Martinez specifically points to two areas of significant concern:

“There is definitely a proposed zeroed out for CDFIs, the community development financial institutions that are mission-based lenders providing capital to small businesses,” Martinez warns. These institutions play a crucial role in financing businesses that traditional banks often overlook, particularly in underserved communities.

Additionally, the budget proposes eliminating several coaching programs through the Small Business Administration, Department of Agriculture, and Departments of State and Commerce that support business development and growth.

“President Trump’s budget brings a reduction of services that small businesses need to survive and grow and thrive,” Martinez emphasizes.

The Potential Elimination of the MBDA

Perhaps most alarming to many small business advocates is the proposed elimination of the Minority Business Development Agency (MBDA). When asked about this proposition, Martinez responded:

“The MBDA was created for a reason. We understand that minority-owned businesses have not been able to access the resources they need to succeed. And that’s a key component of the MBDA’s mission. It’s always a concern when there is a decision to eliminate an agency that is trying to level the playing field.”

The MBDA has historically played a vital role in supporting minority-owned businesses through specialized programs, funding opportunities, and technical assistance.

Practical Strategies for Small Businesses Facing Rising Costs

For entrepreneurs concerned about increasing operational costs and market unpredictability, Martinez offers practical advice:

“I would start with really understanding how their business operates,” she suggests. “It’s really important for them to understand that they’re not alone, that there are still resources available to support them through this process.”

Martinez recommends connecting with free or low-cost consultants through nonprofit organizations that can help business owners:

- Assess and analyze business operations

- Understand the actual costs of their services and products

- Create strategies to pivot or respond to external factors like increasing tariffs

- Minimize the impact on final prices without sacrificing profits

“Thinking through that process and assessing potential strategies and opportunities is going to be key for small businesses to continue in operations,” she advises.

Navigating Access to Capital in a Challenging Environment

Access to capital remains one of the most significant hurdles for small business owners, particularly with proposed cuts to CDFIs. When asked where entrepreneurs should look for funding, Martinez suggests:

“There is a very strong network of mission-based lenders. They are still operating and still committed to supporting small businesses. So, I would encourage them to look for CDFIs.”

She recommends that business owners:

- Visit the CAMEO Network website for a directory of supportive organizations

- Consult the Small Business Administration website for technical assistance providers

- Work with business coaches who can help identify the right type of capital needed

- Seek introductions to appropriate lenders through these support networks

Martinez also cautions entrepreneurs against predatory lenders who may seem attractive during financial distress. “Usually if something is too good to be true, there is a reason for that,” she warns. “We want to make sure that they are asking the right questions… and that they are receiving all the information about the capital product they’re getting into before signing anything.”

How CAMEO Network Advocates for Small Businesses

With three decades of experience supporting small businesses, CAMEO Network serves as both a capacity builder for support organizations and an advocate for entrepreneurs at the policy level.

“We serve like the liaison to bring that information to the key stakeholders like our partners, donors, legislators. We want to make sure that they are clear about everything that is happening translates into the real life, the everyday life of the small businesses,” Martinez explains.

CAMEO Network consistently works to ensure that policymakers understand the real-world impact of their decisions on small business communities. Martinez noted that their advocacy efforts have found support across political lines, with bipartisan support emerging to maintain CDFI fund programs.

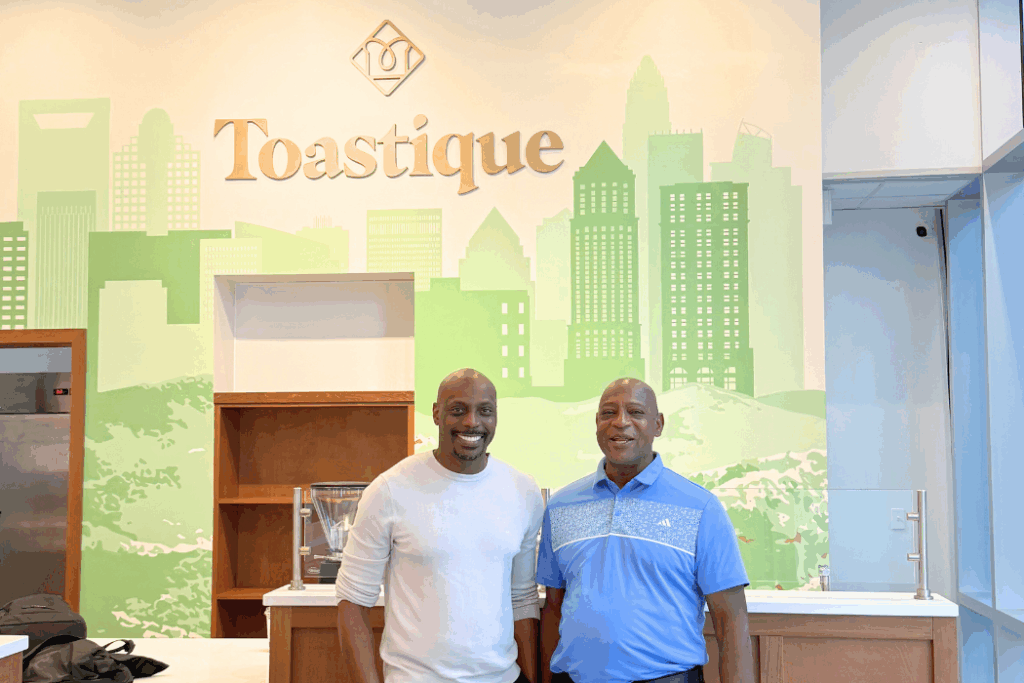

Finding Hope in Challenging Times

Despite the daunting challenges, Martinez remains hopeful about the future of small businesses in America.

“The resiliency of the network and the small businesses is something that really gives us hope and inspires us every day,” she shares. “I feel like people are committed… and just trying to be innovative in how to continue delivering funds and services.”

Martinez finds encouragement in seeing how entrepreneurs persist despite uncertainty: “When we talk to our members, it’s always great to hear them share stories with us of the small businesses that even in the face of so many challenges, so much uncertainty, even so much fear that some of them have, they’re still committed to continue their work.”

Moving Forward Together

National Small Business Week offers a moment to recognize the critical role small businesses play in local economies and communities. As entrepreneurs face unprecedented challenges, organizations like CAMEO Network provide essential lifelines through advocacy, resource connections, and practical guidance.

For small business owners struggling with current economic conditions, Martinez’s message is clear: you are not alone, resources exist to help you navigate these challenges, and with the right support and strategies, your business can continue to thrive even in uncertain times.

Are you a small business owner facing economic challenges? Visit cameonetwork.org to connect with free or low-cost business consultants, find mission-based lenders, and join a community of resilient entrepreneurs working together to overcome today’s obstacles. Your business success story could be the next one shared during National Small Business Week.