BCH’s AMEN Corner – Affluent Minority Entrepreneur News

Many minority-owned businesses begin as lean, founder-driven operations. The owner wears every hat—from CEO to sales lead to bookkeeper. But as the company grows, opportunities expand and challenges become more complex. At some point, the question arises: Should I establish a board of directors? A board can be a game-changer, but it also comes with trade-offs. Let’s break down the pros and cons, how to set one up, and what responsibilities a board should carry.

The Benefits of a Board

Boards can bring very strong benefits that can make a huge difference in strengthening and growing your business.

Strategic Guidance

A board brings experienced voices to the table. Members can help you see blind spots, evaluate growth strategies, and identify risks before they become problems.

Credibility and Trust

Having a board signals stability. Investors, lenders, and corporate partners often view businesses with boards as more professional and reliable.

Expanded Networks

Board members typically bring valuable connections. Their introductions can open doors to contracts, capital, and partnerships that may otherwise be out of reach.

Accountability

Boards hold leadership accountable, ensuring that decisions align with long-term goals instead of short-term fixes.

Succession Planning

For founders thinking about legacy, a board can help prepare the next generation of leaders and keep the business strong beyond one individual.

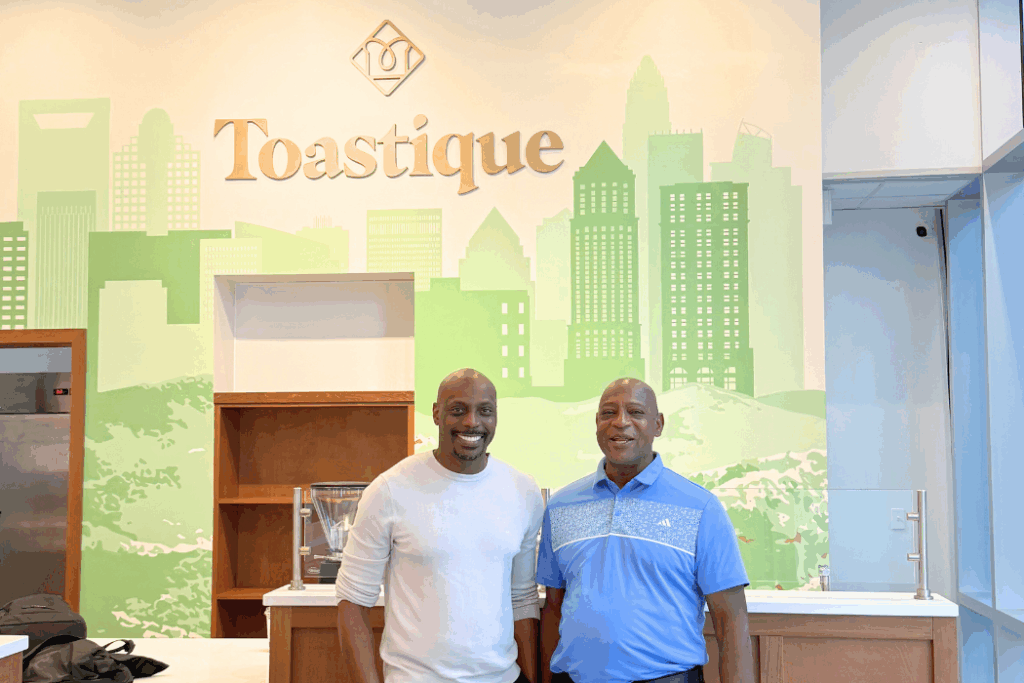

A Real-World Example

Take the story of Walker & Company Brands, the health and beauty company founded by Tristan Walker. When the business began to scale, Walker formed a board of directors that included experienced executives from Google and other major companies. Their input gave the company both credibility and access to networks that helped it secure funding and expand its reach.

Ultimately, Walker & Company was acquired by Procter & Gamble in 2018 — a move that might not have been possible without the strategic oversight and connections of its board. This example shows how the right board can turn a growing business into an enterprise with lasting impact.

The Drawbacks to Consider

You must be able to share information and maybe some control of your business. The tradeoff can be worth the sacrifice if you make the right moves.

- Loss of Control

A formal board, especially one with voting rights, means sharing power. Some entrepreneurs struggle with this shift. - Costs

While not all boards are paid, many require stipends, travel reimbursements, or equity incentives. That adds to overhead. - Slower Decisions

More voices mean more discussion. For fast-moving businesses, this can sometimes delay action. - Risk of Misalignment

If board members don’t fully understand or share the founder’s vision, tension can arise. That’s why careful recruitment matters.

How to Establish a Board

Hire an attorney to help create the documents to ensure that your relationships with board members are legally binding to the extent of their responsibilities and obligations.

- Clarify Your Purpose – Decide why you need a board. Is it fundraising? Strategy? Industry expertise?

- Choose Your Structure – An Advisory Board (informal, no legal authority) is often a good starting point. A Fiduciary Board (formal, with legal duties) is appropriate once investors or outside shareholders are involved.

- Recruit Strategically – Seek diversity in skills and perspectives. Consider finance, legal, marketing, operations, and industry-specific knowledge.

- Define Roles Clearly – Set and manage expectations with bylaws, meeting schedules, and term limits. Clarity prevents confusion later.

- Engage and Empower – A board only works if you provide members with the information they need. Share business data, strategies, goals, and challenges openly.

- Determine the Number – Determine the number of board members. It could be an even or odd number with you being the deciding vote. Choose strategically.

What Boards Do

A board is not there to run your business day to day. Instead, its role is oversight and guidance. Key responsibilities include:

- Governance & Oversight – Ensuring compliance with laws, ethics, and regulations.

- Strategic Direction – Helping chart long-term goals, expansion plans, and investments.

- Financial Stewardship – Reviewing budgets, monitoring financial health, and safeguarding sustainability.

- Risk Management – Identifying and mitigating threats that could derail the business.

- Supporting the CEO/Founder – Serving as advisors, mentors, and sounding boards.

Questions to Ask Before Starting a Board

Be certain that this is the right move at the right time for you and your company.

- What’s my goal?

Am I seeking funding, strategic advice, industry connections, or all three? - Do I need an advisory board or a fiduciary board?

An advisory board is flexible and informal. A fiduciary board carries legal authority and oversight. - Who should I recruit?

Do I have gaps in expertise (finance, legal, marketing, operations) that the right board members could fill? - Am I ready to share control?

A board requires openness, transparency, and sometimes compromise. - Can I commit to engagement?

A board only works if I provide members with the data, updates, and access they need to be effective. - How many members do I need?

Keep the number manageable and focused on your short- and long-term goals.

Is It Right for You?

Not every business needs a board, but for minority-owned companies looking to scale, access larger contracts, or attract investment, it can be a powerful tool. The key is being intentional: build a board that reflects your values, your vision, and the diverse expertise your business needs to thrive.

For founders used to doing it all, creating a board represents a major shift—from running a business to leading an enterprise. That shift may be the very thing that ensures your company not only grows today but endures for generations to come.