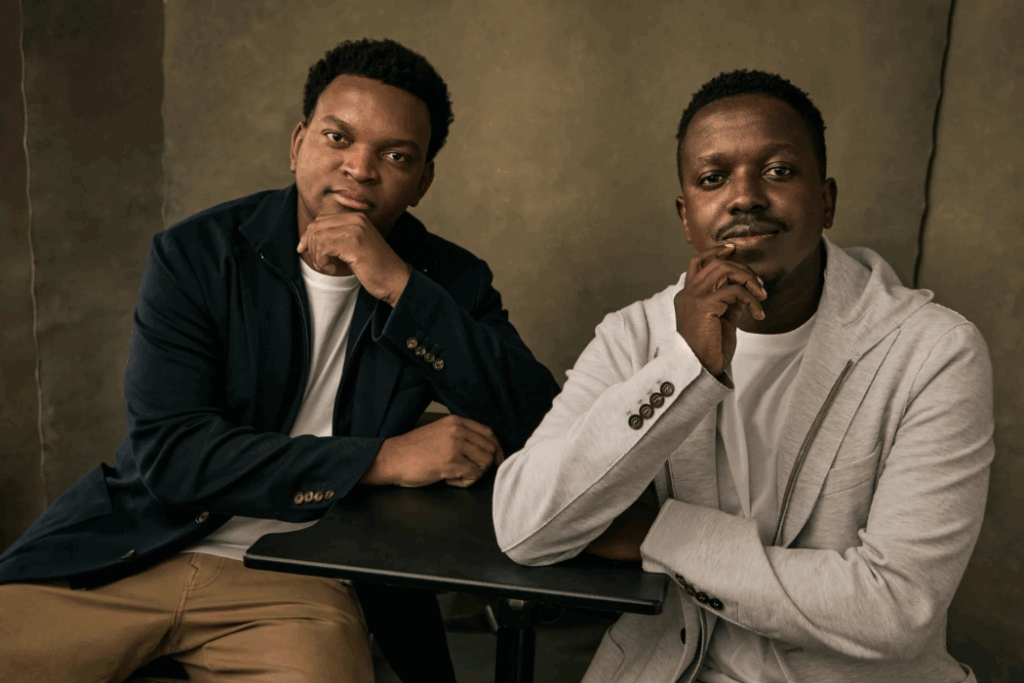

Fredericksburg fiduciary Jeff Smith breaks down the gaps in retirement planning advice—and what everyday Americans actually need to know

According to the National Council on Aging, a retirement crisis shows that 80 percent of older adults are either financially struggling now or at risk for economic insecurity in retirement. With people living longer and goods and services costing more, people must get sound advice regarding financial planning for their retirement. One local financial planning expert is out to give people the scoop on what they need to know so they are protected and ready for retirement.

“There is a lot that financial advisors won’t share with people, and I believe that disservice is going to hurt many people who are trying to plan for their future diligently,” said Jeff Smith, a financial planner and owner of Fredericksburg, Va.-based The Retirement Smith. “This is too important of an issue to trust to just anyone. You must be selective to protect your investment and financial retirement.”

Additional research by The Pew Charitable Trusts reports that millions of people are falling behind on their retirement goals, and nearly a third of retirees are considering returning to work to keep additional funds coming into the home. Just over half of Americans report that they will run out of money when they no longer have a paycheck, and 70 percent of retirees wish they had started saving sooner. They project that vulnerable households are expected to fall around $7,000 short annually by 204.

Smith is trying to help ensure that those in the Fredericksburg area are solid and ready for retirement. He wants people to know some of the most common things that financial planners and advisors won’t share with their clients, including:

- The financial planning industry is broken and too difficult to navigate on one’s own. To ensure that the middle class does not fall through the cracks, it is crucial that they work with a trusted advisor.

- There are gaps in retirement financial planning that must be accounted for. Most people don’t know what they are, but a savvy financial planner will and will help clients navigate them. Many issues must be accounted for, including living longer than anticipated, rising healthcare costs, lower-than-expected investment returns, changes in pensions and other benefits, etc.

- Planners and advisors may have conflicts of interest that they don’t share with their clients. These can hinder planning outcomes and need to be considered. Such planners may be looking to boost their finances at the expense of their clients.

- A financial planner at a large firm will have difficulty providing customized solutions for people. This makes it imperative to work with a small-town fiduciary who will provide a better, more personable experience. They will treat people how they want to be treated and see people as their neighbors.

- Many planners focus on the positives to get people to move forward, but they are not honest and open about the risks involved. People need to know that certain retirement investments come with more risks than others, and they need to know that going in.

“We are not a cold system that merely takes the money and leaves people wondering where it’s going and what to expect,” added Smith. “We take the whole person approach to helping them plan for retirement. It’s the only way to truly help them secure their future, no matter how long they may live.”