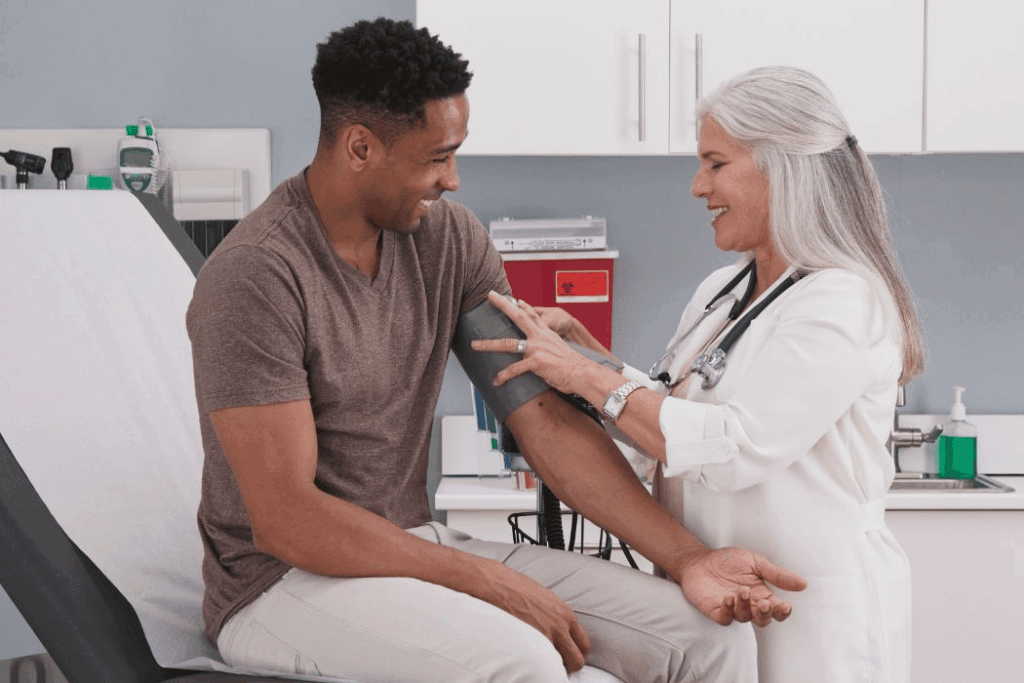

Umpqua Bank, a subsidiary of Umpqua Holdings Corporation, has officially activated its $1 million Umpqua Bank Managed Loan Fund with Kiva, a nonprofit unlocking capital for historically underserved entrepreneurs and their communities. Through Kiva’s innovative crowdfunding microloan platform, Umpqua is providing eligible BIPOC and women entrepreneurs across its footprint accelerated financial support towards a 0 percent interest loan up to $15,000 to finance their emerging business.

Leveraging Kiva’s crowdfunding platform, qualifying business owners in Oregon, Washington, California, and Idaho will receive a triple match from Umpqua for every dollar raised for their business from family, friends, and supporters in their communities.

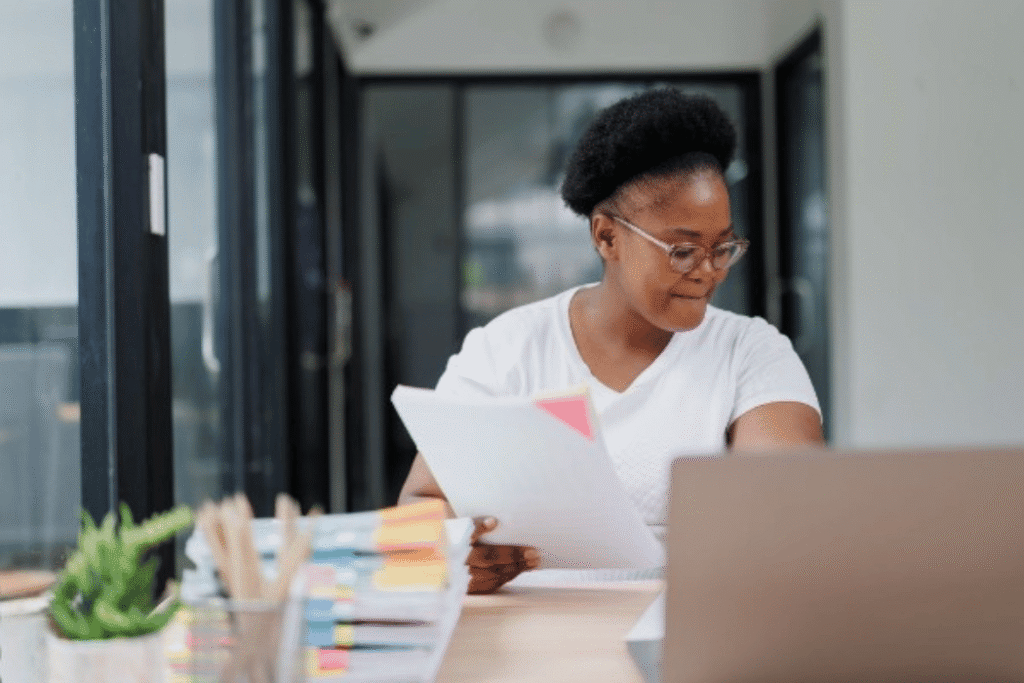

Umpqua is encouraging entrepreneurs in communities it serves to learn more about Kiva and apply for funding.

Umpqua is encouraging entrepreneurs in communities it serves to learn more about Kiva and apply for funding.

“Our partnership with Kiva makes it possible for more entrepreneurs to turn support from their communities into a source of capital that would otherwise not be available,” said Umpqua’s Chief Marketing Communications Officer Eve Callahan. “If individuals believe in and are willing to help finance a local BIPOC or women entrepreneur, Umpqua will triple-match the amount of their financial support so enterprises can more easily and quickly access the financing they need.”

How Kiva Works

For any business owner in need of funding to start, sustain or grow, the only collateral needed to access capital through Kiva is the support of the people and community they serve. Typical barriers to access are removed from consideration, including those related to credit history, physical assets for collateral, citizenship, or verifiable financial track record.

Kiva works hand in hand with entrepreneurs to set a financing goal up to $15,000 and raise contributions from friends, family, and community members on its platform. Kiva also offers access to a global network of lenders interested in supporting businesses. Financial commitments raised are then combined into a 0 percent interest business loan eventually repaid to supporters over three to five years.

Umpqua, through the Umpqua Bank Managed Loan Fund, will help BIPOC and women entrepreneurs reach financing goals more quickly by effectively quadrupling every dollar they raise towards their financing goal.

How to Apply

To apply for Kiva financing and the triple dollar match through the Umpqua Bank Managed Loan Fund, entrepreneurs in Oregon, Washington, California, and Idaho can visit the Umpqua-Kiva partnership page. The initial application process typically takes between 20 and 30 minutes.

The Kiva partnership is part of Umpqua’s Small Business Empowerment Program, which brings together the bank’s various initiatives to improve access to funding, products/services and expertise under one strategic umbrella. Along with Kiva, the Small Business Empowerment Program includes partnerships with organizations that are often the first step for entrepreneurs interested in accessing Kiva funds, including: Oregon-based MESO (Micro Enterprise Services of Oregon); Washington-based Business Impact NW; and California-based Centro Community Partners.

“We are excited to partner with Umpqua Bank as part of its Small Business Empowerment Program to provide additional loans and unlock capital for under-resourced entrepreneurs,” said Sarah Marchal Murray, Chief Strategic Partnerships Officer at Kiva. “Ensuring every business owner has equal access to capital and other resources to succeed is important for creating strong and vibrant communities. Partnering with Umpqua, Kiva is honored to extend our platform’s reach to more communities across the West Coast.”