Black founded and led fintech MoCaFi (Mobility Capital Finance, Inc.) recently hosted a conversation at the California African American Museum with their corporate and community partners to discuss collective solutions to address the wealth gap in Los Angeles.

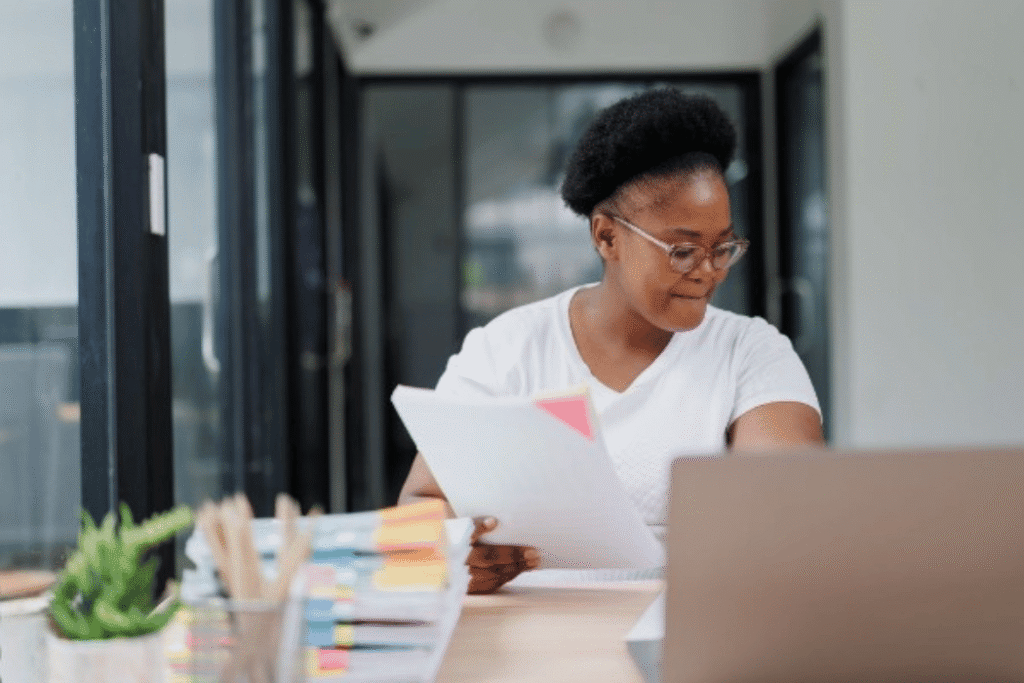

“We are proud of the partnerships we have developed with businesses and community organizations in the Los Angeles area to empower Angelenos marginalized by systemic financial exclusion,” said Wole Coaxum, founder, and CEO of MoCaFi. “MoCaFi is committed to connecting them with human, social, and financial capital required to create generational wealth.”

MoCaFi was joined by VantageScore, Wells Fargo, Mastercard, the City of Los Angeles, Slauson & Co., iHeart Media, ThinkWatts, Sole Folks, Prosperity Market, and Thai CDC in the conversation. The two-panel discussion focused on addressing the disparities in homeownership, rent burden, and access to credit and capital.

“We are pleased to partner with MoCaFi towards addressing solutions to close the wealth gap by financially empowering disadvantaged communities,” added Silvio Tavares, President, and CEO of VantageScore. “By defining innovative pathways through data analytics, we strive to improve consumers’ credit health and facilitate homeownership and generational wealth opportunities.”

Last year, MoCaFi partnered with the City of Los Angeles to oversee the implementation of their unified digital financial product, the Angeleno Connect Bank Account. The platform provides a quality, digital bank product for populations unbanked or residing in banking deserts in the Greater Los Angeles area. Wells Fargo and Mastercard are partners in this endeavor, with Wells Fargo offering MoCaFi customers the ability to use their Angeleno Connect card at Wells Fargo ATMs nationwide without incurring fees from Wells Fargo.

“We believe technology innovation has a major role to play in solving big, complex urban problems – specifically by combining the scale, expertise, and reach of public and private organizations,” said Steve Tae, Vice President, Mastercard Enterprise Partnerships. “Through strong collaboration, we can expand programs like our Angeleno Connect Card to ensure vulnerable segments of the population and underinvested communities have the financial tools to succeed.”

“We are proud to support the And Finance for All series that will facilitate productive conversations about financial inclusion and economic equality and help mobilize these conversations into action,” says Darlene Goins, head of Wells Fargo’s Banking Inclusion Initiative. “MoCaFi shares our commitment to bringing more unbanked individuals in historically underserved communities into mainstream banking. This event is another important way we continue to address the wealth gap and advance financial inclusion collectively.”