New Majority Capital (NMC), a DEI Impact firm announced the raising of its seed round funding from a community of investors using the WeFunder platform.

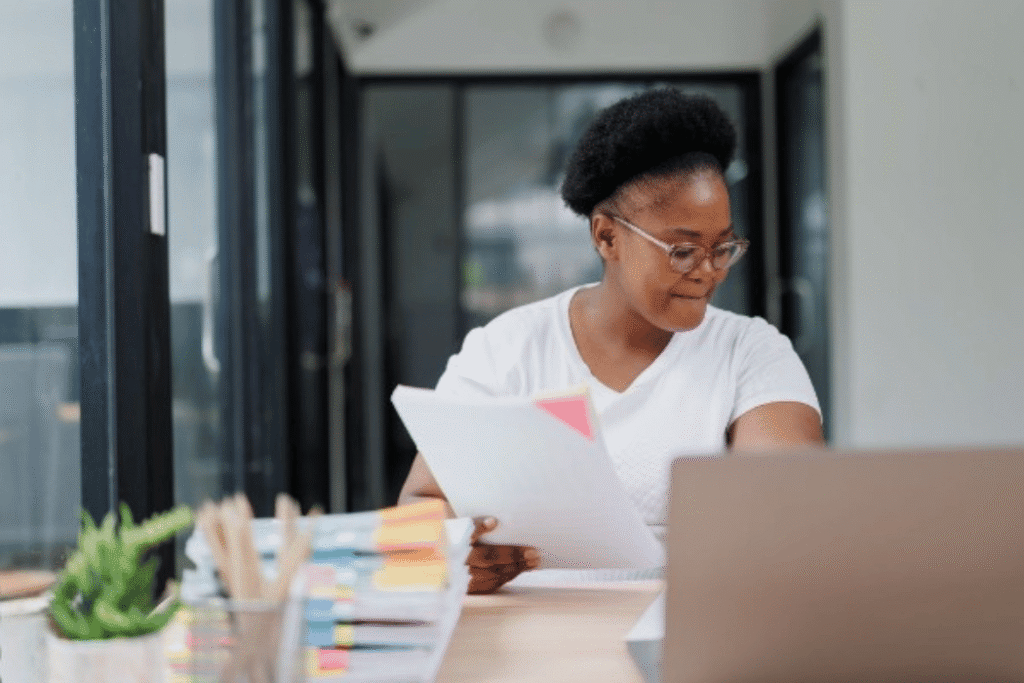

NMC is focused on closing the racial and gender wealth gap in the U.S. Its strategy for doing so includes providing access to educational and technical resources to BIPOC and Women who want to pursue entrepreneurship through acquisition (ETA). NMC also intends to offer due diligence and other support to investment funds that provide and non-extractive or entrepreneur-friendly capital capital for such acquisitions. NMC supports investment strategies that enable BIPOC and women to acquire an existing,cash flow generating business, usually from a retiring owner, as opposed to starting a business from scratch.

Co-founder Allegra Stennett explains, “Too many people think of entrepreneurship exclusively as starting a business from scratch. This involved significant risk as evidenced by the 75 percent failure rate of startups. ETA, on the other hand, is much lower risk, since the business already has customers, suppliers, operations, and generates steady cash flows.”

NMC’s Wefunder community round is open to non-accredited and accredited investors using Reg-CF. Kris Schumacher, Co-founder of NMC commented: “We intentionally chose WeFunder’s platform because we wanted everyday folks who are interested in our mission to be able to gain financial and impact returns and participate as a stakeholder.” The round was kicked off by RSF Social Finance with funding coming from a wide range of investors, who have provided testimonials to make this impact investment opportunity more widely known within their communities. Some investors are coming in through Donor-Advised Funds (DAF) platforms such as Impact Assets and Realize Impact. DAFs are getting popular given their tax efficiency and increased usage by billionaires like MacKenzie Scott and Elon Musk.

Most recently, LunaCap Ventures founder, Paul Capon made a significant, catalytic investment in NMC. Paul Capon commented: “Small business asset ownership is the way to go to close the wealth gap for aspiring BIPOC and women entrepreneurs in the US. It truly helps with inter-generational wealth creation that most existing business owners and their families have benefited from.”

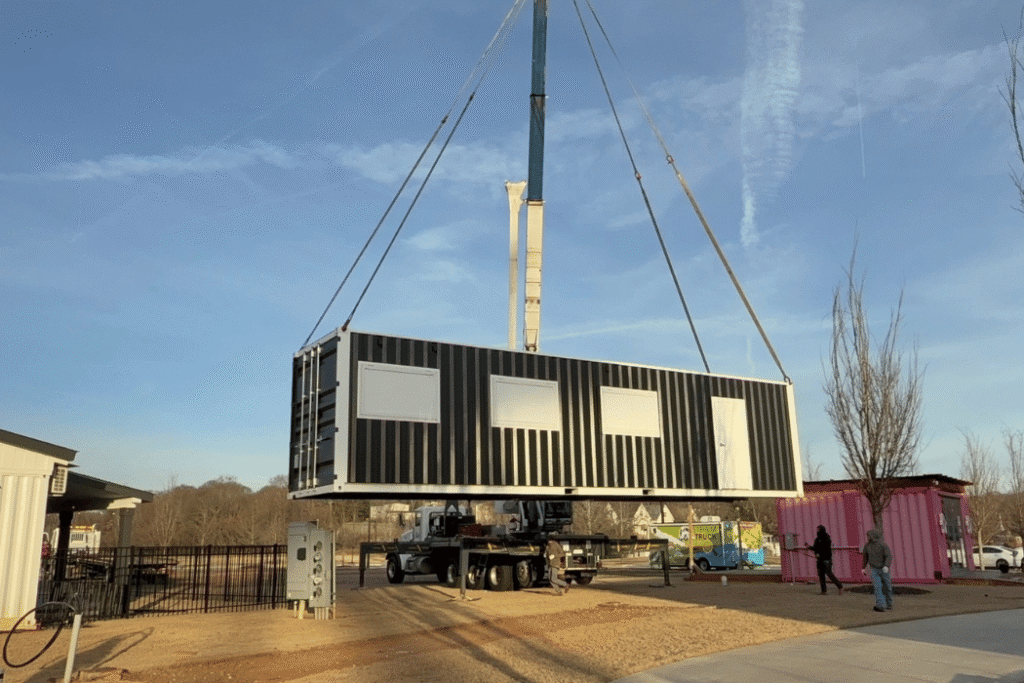

Since launching its service offering in January of this year, NMC has had very good traction with prospective business owners. The firm is currently helping over 20 BIPOC and/or women entrepreneurs close their acquisitions in businesses ranging from HVAC to janitorial services to niche manufacturers. Darryl Lindie, co-founder of NMC reports, “Given the silver tsunami of baby boomer owners retiring from their businesses, this is a timely opportunity to help them realize full value for what they worked hard to create and to also give under-represented folks an opportunity to become business owners and work on inter-generational wealth creation.” NMC’s partners on skills training/ ETA curriculum development include Babson College and ICIC, two organizations that helped deliver the successful Goldman Sachs 10K Small Business program.

NMC is targeting the systemic barriers to entrepreneurship and business ownership to make this path of intergenerational wealth creation available to as many qualified BIPOC and Women entrepreneurs as possible. Last month, the firm announced the launch of a Pre-Acquisition Revolving Fund, in partnership with Community Credit Labs (recently acquired by Common Futures) to provide 0 percent financing for qualified entrepreneurs, regardless of their credit score, to cover pre-acquisition costs such as out of pocket expenses for service providers or for down payments.

To fund the acquisitions, NMC has partnered with a few CDFIs and few select preferred SBA 7A loan lenders that are mission-aligned and open to entrepreneur-friendly terms in their structuring. NMC’s long term plans are to support the development of a Revenue-based Financing Fund that can be used for 100 percent of the acquisition value. The firm intends to design the fund in a way that is attractive to foundations for PRI and MRI investments, banks for CRA credits and for accredited impact investors in general using a third party firm to measure and report on their impact. According to Havell Rodrigues, co-founder from NMC: “The firm’s goal is to support models that are non-extractive/entrepreneur-friendly, flexible, generate returns for investors and meet our BIPOC and women entrepreneurs where they are”.