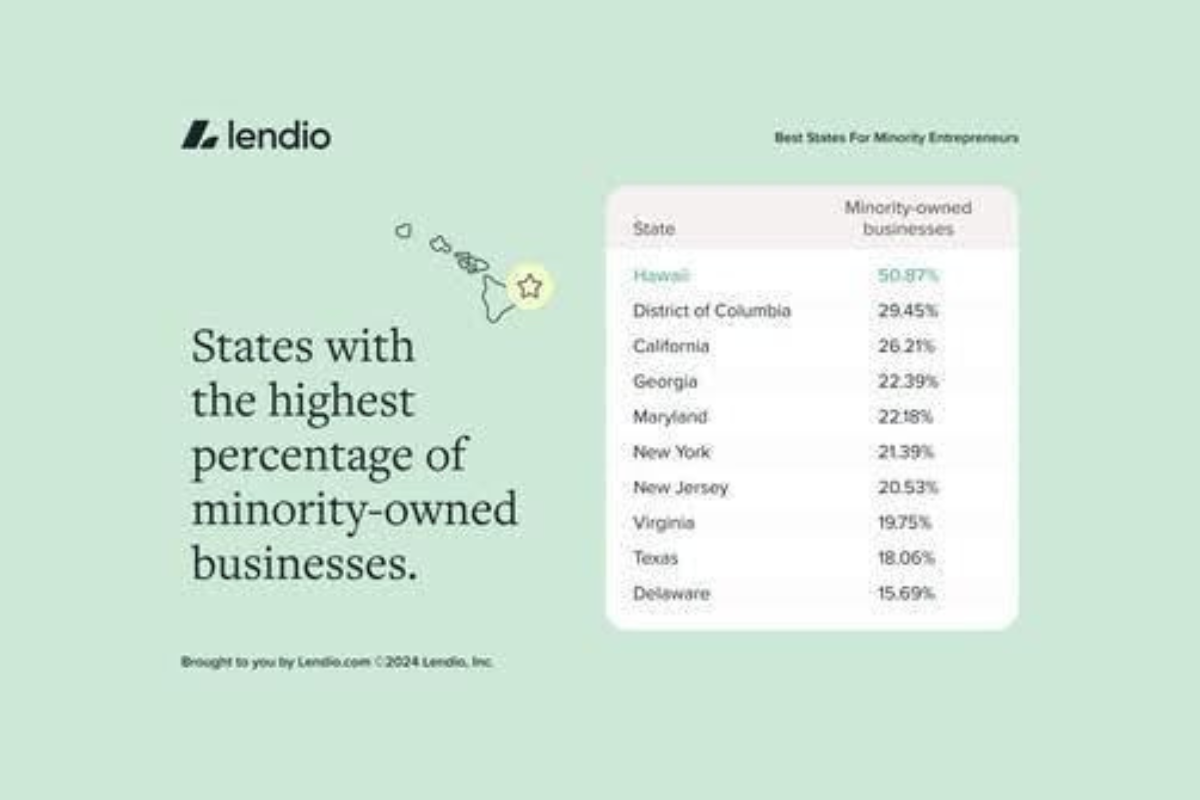

A new study from Lendio ranks the top 20 states for minority entrepreneurs. To produce the rankings, Lendio evaluated eight critical metrics including small business loan accessibility, entrepreneurship rates, job growth, and income equality.

Vermont, with high business loan approval rates, high minority-owned startup growth, low unemployment, and lower income disparities, takes the spotlight as the number one state for minority entrepreneurship. Wyoming, South Dakota, North Dakota, New Hampshire, Montana, Maine, Utah, Kansas, Minnesota, Maryland, Idaho, Oregon, Colorado, Missouri, Nebraska, Florida, Ohio, Wisconsin, and Massachusetts also made the list.

Notably, of the states with the highest absolute percentage of minority-owned businesses (Hawaii, Washington D.C., California, Georgia, and Maryland), only Maryland made the top 20 list. The others were pushed down in the rankings due to the fact that minority business ownership rates were lower relative to the state’s minority population, along with other factors analyzed.

“Access to funding is critical to the success of a small business, but there is a lending gap experienced by minority entrepreneurs,” says Brock Blake, CEO and co-founder of Lendio. “This disparity, where white entrepreneurs outpace their Asian, Hispanic, and Black counterparts in securing funding, is a clarion call for targeted policies and programs to bridge this inequality.”

According to data from the 2022 Small Business Credit Survey, 52 percent of white entrepreneurs are fully approved for financing, compared with 35 percent of Asians, 28 percent of Hispanics and 27 percent of Black applicants.

“By shedding light on these issues, we aim to spur action towards leveling the playing field for all entrepreneurs,” said Brock. “We applaud governments and organizations working to provide policies and resources that support these underserved communities and are excited by new technology advancements in loan underwriting that will make access to capital more equitable.”

To access the full study, visit Lendio’s website.