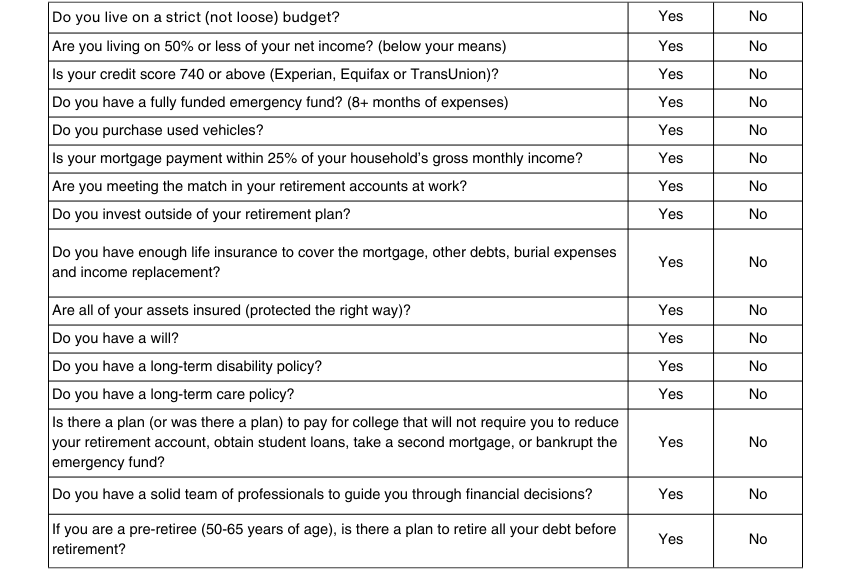

As we look ahead to 2024 has your North Star shifted? Take our financial assessments to see what adjustments you need to make to reach your financial goals and start the year off with a clear path to prosperity.

Personal Financial Management

This assessment helps put things in perspective where you might have a few gaps. It offers insights on how well you have managed your financial life. The questions are directly related to our curriculum Destination: Financial Wellness and the financial journey it takes you on. Remember, this applies to your spouse as well. It is important to see where we are today to understand what lays ahead. While you might measure below par at first, once you successfully make it through this journey and make adjustments, your score will improve.

Circle “yes” or “no” to the following questions:

Rating: Count the number of times you answered “yes.”

Superior: 16-15

Excellent: 14-13

Great: 12-10

Good: 9-7

Fair: 6-4

Poor: 3-0

Financial Wellness Assessment

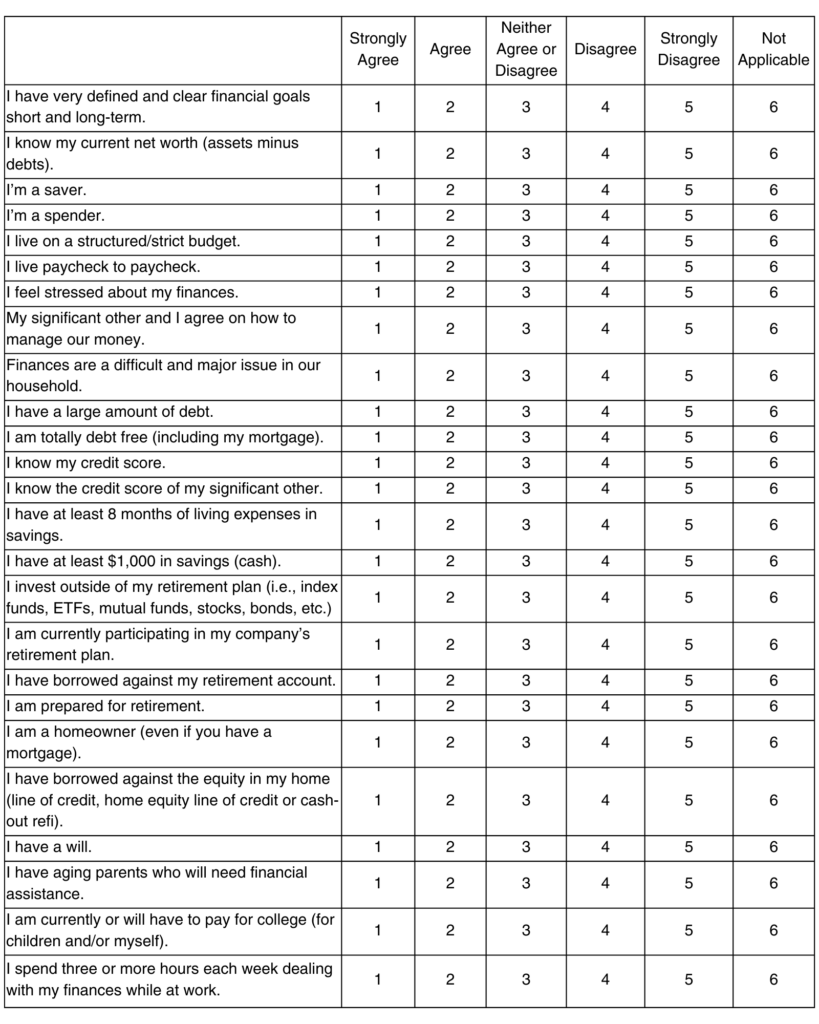

Another beneficial assessment to take is to rank your beliefs about money and comfort level in reaching your North Star. This allows you to take an honest look at your financial habits and identify areas of growth to tackle in 2024. Remember, all of life is learning and when we make mistakes—we learn A LOT! Take that hard earned experience and apply it to learning programs like Destination: Financial Wellness and other resources to gain the skills and confidence you need to make financial decisions that will ultimately build wealth for you and your family. It takes continual practice to reach financial wellness and each day that we are blessed to be here we get another opportunity to practice!

Please circle the appropriate number to indicate the extent to which you agree or disagree with each statement below.

Take a look at the areas in which you feel confident and notice the areas you need to improve. Does anything surprise you? Understanding where you rank is only one part of the equation. The other half is taking steps to educate yourself on the changes that you need to make to plan for a secure financial future. We like to say that knowledge is the new currency and we hope our monthly columns in MBE have made you knowledge-rich! We know through our experience educating thousands of people about financial wellness, it does not matter where you start as long as you get started—it’s more important where you finish!

Last month, we asked, “Are You Planning to Give Company Bonuses This Year? If So, What is the Amount Based On?” We heard 50 percent of respondents plan to give a company bonus at year end. And 100 percent will base bonuses on a combination of individual and company performances.